st louis county mn sales tax

Drop Box located to the right of the entrance doors of Service Center. Other departments may be able to help if you are looking for.

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

The Saint Louis County Minnesota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Saint Louis County Minnesota in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Saint Louis County Minnesota.

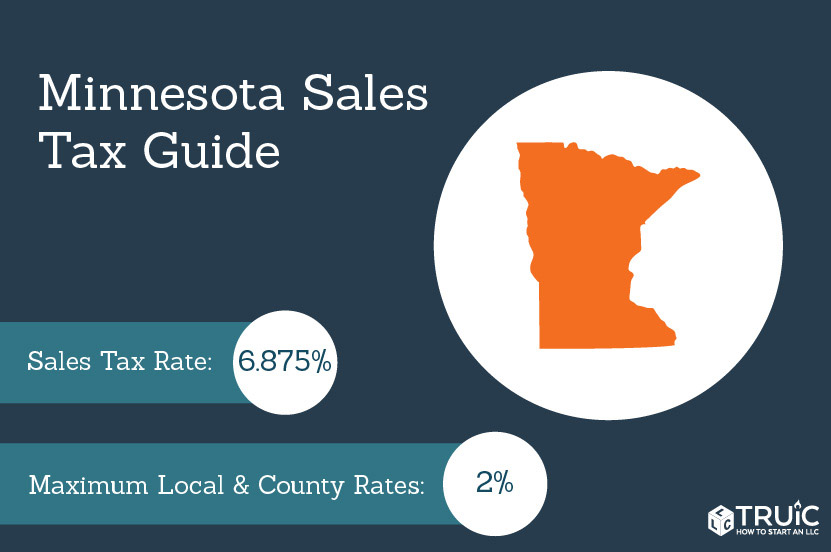

. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. Starting April 1 2015 St. Louis County will have a 05 percent transit sales and use tax and a 20 vehicle excise tax.

The Minnesota state sales tax rate is currently. There are three options. These parcels are subject to a MN Department of Transportation right of way easement.

082019 - 092019 - XLS. Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55. Property Tax Look Up.

Louis County Minnesota sales tax is 738 consisting of 688 Minnesota. Drop box located on Virginia GSC entrance on. Read through Contractor Pre-work Session Online.

This is the total of state and county sales tax rates. 38 rows St Louis County Has No County-Level Sales Tax. Tax Forfeit Land Sales.

The 2018 United States Supreme Court decision in South Dakota v. Below are some tools to help you find property information that you may be looking for. The current total local sales tax rate in Saint Louis Park MN is 7525.

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. Louis County Minnesota is 1102 per year for a home worth the median value of 140400. Saint Louis Park MN Sales Tax Rate.

The Minnesota Department of Revenue will administer these taxes. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. What is the sales tax rate in St Louis Park Minnesota.

This is the total of state county and city sales tax rates. Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval.

The median property tax in St. The St Louis County Sales Tax is 2263 A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. You must register on the Public Surplus website in order to bid online.

3 rows Saint Louis County MN Sales Tax Rate. 6 rows The St. Complete the pre-work session at a Land and Minerals Department Office.

The minimum combined 2022 sales tax rate for St Louis Park Minnesota is. The St Louis Park sales tax rate is. A pre-work session is required before harvesting can start.

The current total local sales tax rate in Saint. We will not contact you unless there is an issue. This is the total of state and county sales tax rates.

These buyers bid for an interest rate on the taxes owed and the right to. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015. To further accelerate investment and improve the quality of the countys vast.

Tax forfeited land managed and offered for sale by St. The County sales tax rate is. Louis County collects on average 078 of a propertys assessed fair market value as property tax.

Did South Dakota v. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Saint Louis County MN at tax lien auctions or online distressed asset sales. The right to withdraw any parcel from sale is hereby reserved by St.

The December 2020 total. Virginia Government Service Center GSC 201 S. The St Louis County sales tax rate is.

This - 50 x 125 tract is zoned R-1 Residential. Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2. Saint Louis County MN currently has 184 tax liens available as of February 12.

Pursuant to Minnesota Statute 28204 Subdivision 1 d as directed by the county board the county auditor may lease Tax Forfeited land to individuals for the removal of gravel. Minnesota is ranked 1326th of the 3143 counties in the United States in order of the median amount of property taxes collected. Filling out this form does not register you for bidding on Public Surplus.

Permit fees do apply. Has impacted many state. The Minnesota sales tax rate is currently.

While many counties do levy a countywide. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. Revenues will fund the projects identified in the St.

Contact the Sale Administrator and go through out on site or at an alternate location. State Muni Services. You may pre-register to ensure that you are eligible to bid on and purchase tax forfeited land in St.

Checks made payable to. Tax Forfeited Land Sales. Contact City of Duluth Planning and Development for permitted uses and zoning questions.

Minnesota Sales Tax Rates By City County 2022

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota

Minnesota Sales Tax Small Business Guide Truic

St Louis County Land Sale Home Facebook

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Economic Development Plan Slc Mn

Minnesota Clothing Sales Tax Exemption Appreciation Perfect Duluth Day

Map Of The Day State Highway Taxes Vs State Highway Spending Streets Mn

St Louis County Land Sale Home Facebook

St Louis County Land Sale Home Facebook

Minnesota Sales And Use Tax Audit Guide

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More