unified estate tax credit 2021

Gifts and estate transfers that exceed 1206 million are subject to tax. Qualified Small Business Property or Farm Property Deduction.

After the unified credit limit is reached the donor pays up to 40 percent on.

. The gift and estate tax. This is called the unified credit. What Is the Unified Tax Credit Amount for 2021.

This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples. Currently you can give any number of people up to 16000 each in a single year without incurring a taxable gift 32000 for spouses. The unified credit is per person but a married couple can combine their exemptions.

The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. For 2021 that lifetime exemption amount is 117 million. What Is the Unified Tax Credit Amount for 2021.

In other words use it or lose it. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

For 2009 tax returns every American received an automatic unified tax credit against federal estate and gift taxes of 1455800 which is equivalent to transferring 35. For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

For 2021 the estate and gift tax exemption stands at 117 million per person. The basic exclusion amount for determining the unified credit against the estate tax will be 11700000 up from 11580000 for decedents dying in calendar year 2021. The tax is then reduced by the available unified credit.

If youre responsible for the estate of someone who died. In Revenue Procedure 2021-45 RP-2021-45 irsgov the Internal Revenue Service announced annual inflation-adjusted tax rates for 2022 including. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is.

Your estate tax exemption will be reduced if you made any taxable gifts during your lifetime that exceeded. The unified tax credit is a term encompassing two or more tax exemptions that taxpayers can use in combination to transfer substantial amounts of assets to heirs without triggering the need to. The credit is first applied against the gift tax as taxable gifts are made.

Any tax due is. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. 2020-45 which sets forth inflation-adjusted items for 2021 or various provisions of the Internal Revenue Code.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special. The exclusion amount in. The gift and estate tax.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of. This is called the unified credit. The amount of the estate tax exemption for 2022.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. For 2021 the estate and gift tax exemption. News November 29 2021.

In October 2020 the IRS released Rev. How the gift tax exclusion works.

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

What Is The Unified Tax Credit How Does It Change Federal Gift And Estate Taxes

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

U S Estate Tax For Canadians Manulife Investment Management

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Gift Tax Exclusion Essential Info Understand The Unified Credit

U S Estate Tax For Canadians Manulife Investment Management

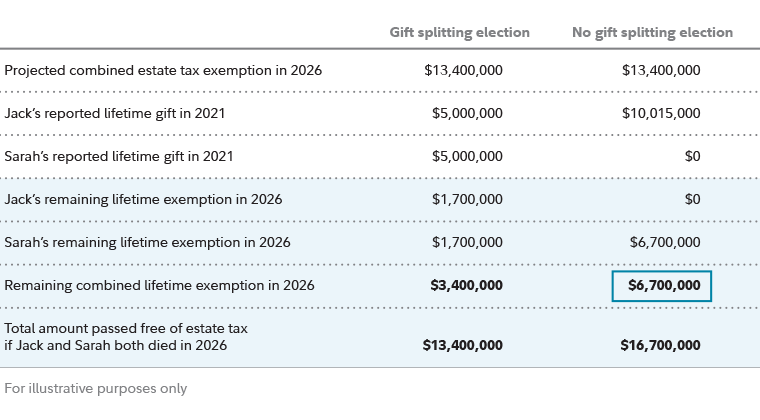

Estate Planning Strategies For Gift Splitting Fidelity

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Historical Estate Tax Exemption Amounts And Tax Rates 2022

U S Estate Tax For Canadians Manulife Investment Management

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)

/UnifiedTaxCredit-d90e228472aa44e88eebc9866e3045d9.jpg)