do you pay taxes when you sell a used car

You can determine the amount you are about to pay based on the Indiana excise tax table. In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot.

Free Motor Vehicle Dmv Bill Of Sale Form Word Pdf Eforms

When it comes time to calculate your total income to report on your 1040 form you need to include all the money.

. The sale must also be reported to the Missouri Department of Revenue and the seller must complete a notice of sale or bill of sale. Most car sales involve a vehicle that you bought new and are. You do not need to pay sales tax when you are selling the vehicle.

If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on. Answered by Edmund King AA President. You do not need to pay sales tax when you are selling the.

When you sell a car for more than it is worth you do have to pay taxes. The short answer is maybe. For example if you bought the two-year-old SUV for the original retail price of.

What to know about taxes when you sell a vehicle Carvana. Selling a car for more than you have invested in it is considered a capital gain. A lien release from a lender if applicable 1.

Thus you have to pay. Although a car is considered a capital asset when you originally purchase it both state. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

Even in the unlikely event that you sell your private car for more than you paid for it special. Do you have to pay income tax after selling your car. Thankfully the solution to this dilemma is pretty simple.

However you do not pay that tax to the car dealer or individual selling the. The buyer is responsible for paying the sales tax. You dont have to pay any taxes when you sell a private car.

2 hours ago Thankfully the solution to this dilemma is pretty simple. When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle. There are some circumstances where you must pay taxes on a car sale.

Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds. So if your used vehicle costs 20000. When you sell your car you must declare the actual selling purchase price.

When I Sell My Car Do I Have To Pay Taxes Carvio

Car Tax By State Usa Manual Car Sales Tax Calculator

Understanding Taxes When Buying And Selling A Car Cargurus

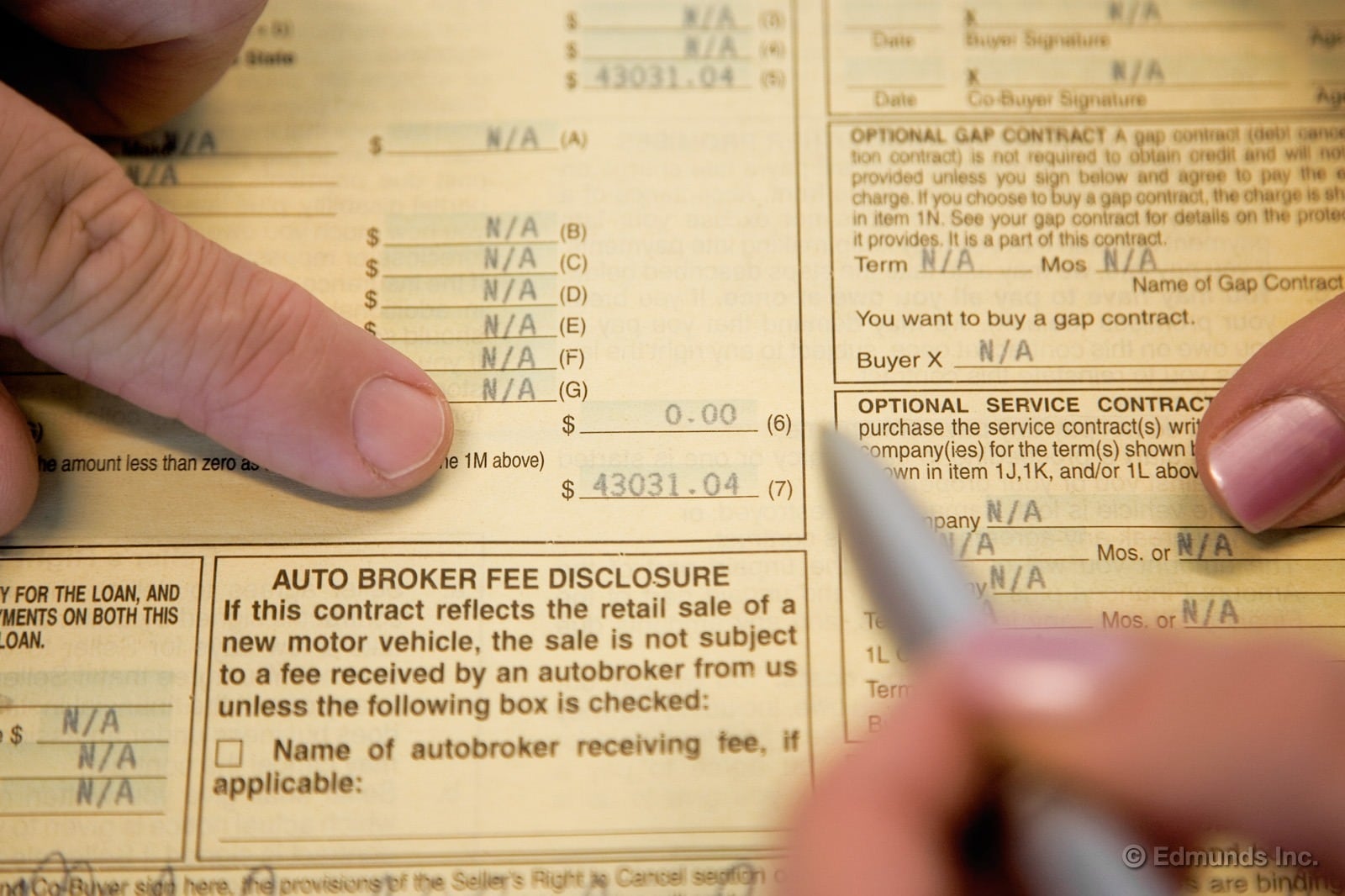

How To Close A Private Car Sale Edmunds

How To Gift A Car A Step By Step Guide To Making This Big Purchase

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

What S The Car Sales Tax In Each State Find The Best Car Price

When I Sell My Car Do I Have To Pay Taxes Carvio

How Does Trading In A Car Work U S News

I Want To Sell My Car But I Still Owe Money News Cars Com

Selling To A Dealer Taxes And Other Considerations News Cars Com

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

How Do I Get A License To Buy Cars At Auctions

Can You Sell Your Car Without Paying Taxes Sell The Car Usa

Do You Pay Sales Tax On A Lease Buyout Bankrate

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Vehicle Sales Tax Deduction H R Block

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense